The workers’ compensation sector of the commercial insurance industry is generally a stable and profitable segment. However, the claims in this market have become costlier, with concerns over severity on the rise. While the frequency of claims has declined, several factors contribute to increasing claim expenses.

Read MoreWhat does LLC mean? LLC stands for Limited Liability Company. Many small business owners choose to operate as an LLC because it protects them from being personally liable. This means business creditors cannot go after their personal assets such as their houses or vehicles. LLCs are relatively simple to set up and also offer tax advantages and other benefits. Wondering if an LLC might be the right business structure for you?

Read MorePicture this scenario – you just received a call from a premium auditor looking to schedule a visit to perform a premium audit on their recently expired workers’ compensation policy. The premium audit is a very important function. Not only does it determine the final premium for an insurance policy, but the data collected at audit is later submitted to rating organizations to be used in developing experience modifiers and loss costs.

Read MoreIn a news release, the U.S. Department of Labor recently reminded employers hiring youth-aged workers to comply with federal child labor laws to ensure these hires have a safe and beneficial experience.

Read MoreInflation is the number one concern of small businesses owners, according to a recent survey conducted by the U.S. Chamber of Commerce. To cope with inflation, 67% of small businesses have raised prices, according to the study. Another four in ten (41%) report having decreased staff or taken out a loan in the past year (39%) in response to growing inflation pressures.

Read MoreNational Insurance Awareness Day serves as a reminder to all small business owners to review their insurance policies to make sure they have the right coverage for their organizations. In this article, we'll take a look at three things business owners can do to ensure they have the right small business insurance.

Read MoreBetween December 2020 and December 2021, the Consumer Price Index for used cars and trucks increased 37.3% and the CPI for new vehicles increased 11.8%. Therefore, the cost to replace a vehicle in the event of a loss has increased.

Read MoreAny business could face the risk of a data breach or cyber attack. Regardless of how big or small your business is, recovering from the aftermath could be difficult if your data, important documents, or customer information is exposed.

Read MoreThe pressure and stress employees are under when short-staffed can degrade a business’s service and quality output. This decline directly impacts customers and can negatively affect a brand’s reputation and sales. However, there are solutions for businesses to maintain the level of customer service your patrons expect, even with an undersized staff.

Read MoreThere are so many things that are out of your control like equipment breaking down, fire, wind, lightning, and theft. We don’t think those things should interfere with your ability to do business. That’s why we offer equipment breakdown coverage and business interruption coverage!

Read MoreGetting the proper insurance coverage and licenses is just a start. To run a successful business, you’ll also likely need the right bonds. So, what are bonds for small businesses? Bonds guarantee that your small business will perform the agreed-upon services.

Read MoreIn a March 21, 2022 statement, President Joe Biden cautioned businesses in the private sector to harden their cyber defenses, reiterating earlier warnings related to potential cyberattacks against U.S. organizations by Russia. Cybersecurity is an ongoing challenge, but organizations aren’t alone when it comes to safeguarding their digital assets.

Read MoreThese days, cybercriminals are organized and well-funded. Unlike a lone threat actor, ransomware groups will reinvest a portion of their profits into hiring and training talented cybercriminals, making them more dangerous to organizations. As ransomware tactics evolve, it’s important for organizations to be up to date on current ransomware techniques.

Read MoreOwning and operating a landscaping business has a list of responsibilities and its fair share of risks no matter if it’s a startup or large corporation. Team and customer safety should always be top-of-mind, which is why commercial landscaping insurance is essential to your business’s success.

Read MoreAs a small business owner, your company is built on a reputation of good, honest work. When you’re expanding your team and bringing in employees to help support that work, you’re probably looking for people that have those same values. But what if they don’t? It’s a scary thought that the people you hire and trust to carry out the vision of your business could be the very people taking advantage of it.

Read MoreHiring seasonal workers is a necessity in some industries such as construction, manufacturing, agriculture, lawn care and retail. These workers can boost production during the summer, over the holiday season or when there’s a large contract to fulfill.

Read MoreThe IRS recently announced that payment apps such as PayPal, Venmo and CashApp will be required to issue 1099s to small businesses and self-employed persons. The problem is these taxpayers don't have accounting departments and professionals to rely on.

Read MoreCompanies across the country are experiencing labor shortages for a variety of reasons. Find out how these staffing shortages can impact workers’ compensation and what businesses can do to help deal with them.

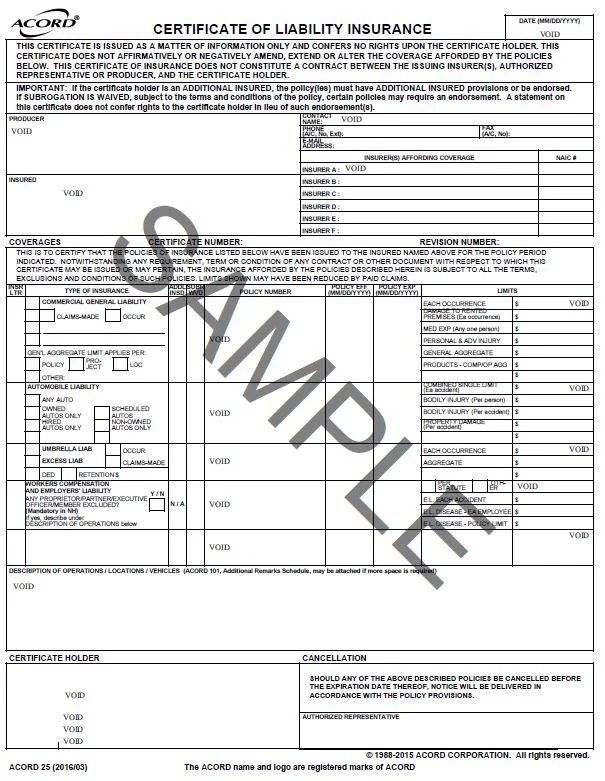

Read MoreA certificate of insurance is a document from an insurer to show you have business insurance. This is also called a certificate of liability insurance or proof of insurance. With a COI, your clients can make sure you have the right insurance before they start working with you.

Read MoreIs your business protected if valuable papers like blueprints get lost on the way to meet a client? What about if you are renting expensive equipment and it gets damaged? Or your own tools get damaged while trying to get from one place to another? A basic business insurance policy is going to cover well … the basics, but you need a policy unique to contractors to ensure you’re protected in the gray area.

Read More