Savvy business owners know to follow safety precautions and best practices for the workplace. But whenever you or an employee leave your premises to conduct business off-site, the liability risk doesn’t end there. Do you have the right off-site safety measures in place?

Read MoreDid you know a man sued Uber for ruining his marriage because his wife used the app to discover he was having an affair? Lawsuits impact businesses every year. If your business is involved in one, it can cost you tens of thousands of dollars to defend yourself. The right insurance policies can make all the difference in keeping your small business operating during a lawsuit and financially viable afterward.

Read MoreDespite the hard work that small businesses put in to ensure they manufacture high-quality goods, there is still the chance that products could fail to work properly. Find out what product liability insurance is and how much your small business might need.

Read MoreA general liability policy helps protect your small business from claims that it caused bodily injuries and property damage. These risks can come up during normal business operations. They can get expensive for small businesses and many don’t have the resources to cover a liability claim.

Read MoreAn important part of understanding your responsibility for products and services is to understand how that responsibility is defined by law. Although various states and countries have differing laws relating to enforcement of legal liability, two legal theories typically apply to product liability: negligence and strict liability of defective products.

Read MoreEntering into a contractual relationship can expose your company to significant contract liability. Implementing standard safeguards indicates a well-rounded risk management program that guards against potential losses. An organization should require a contractor to assume liability arising out of the contractor’s negligent conduct, delivery of products, services or activities.

Read MoreHiring seasonal workers is a necessity in some industries such as construction, manufacturing, agriculture, lawn care and retail. These workers can boost production during the summer, over the holiday season or when there’s a large contract to fulfill.

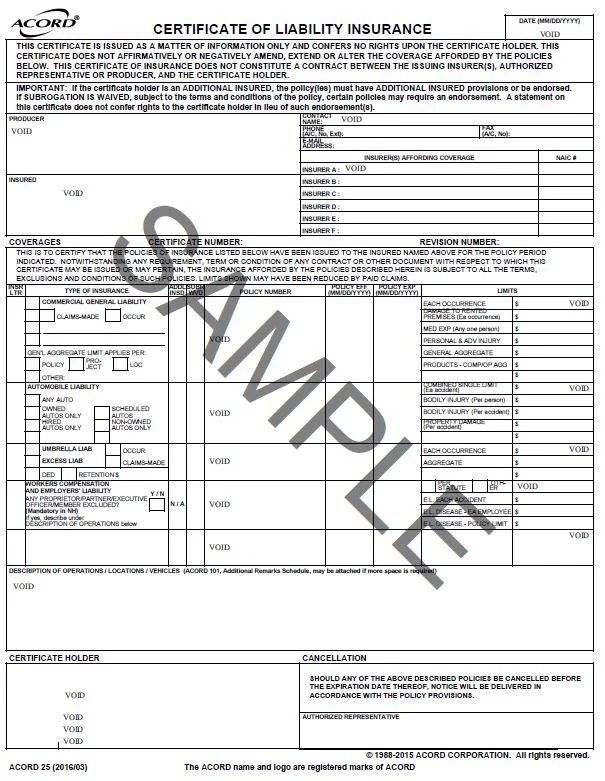

Read MoreA certificate of insurance is a document from an insurer to show you have business insurance. This is also called a certificate of liability insurance or proof of insurance. With a COI, your clients can make sure you have the right insurance before they start working with you.

Read MoreWorking in winter weather conditions can be risky for employees. Learn winter weather safety tips to implement at your small business that could lower the risk of injuries for your outdoor workers.

Read MoreThe Occupational Safety and Health Administration (OSHA) recently cited a company for exposing their workers to unsafe levels of airborne lead. They proposed a fine of over $319,000. This is just one example of citations and fines that OSHA can impose on a business for workplace safety violations. Do you know the other types of violations?

Read MoreNational Preparedness Month, celebrated every September, is a great time for small business owners across the country to revisit and adjust their own disaster recovery plans.

Read MoreWhen it comes to poaching data, hackers tend to focus on easy prey: small businesses. Why? They often lack strong security measures and standards. Likely due to their leaner teams and many hats. So, how can your small business protect itself?

Read MoreHome business, small business, global business—here’s how to choose the right insurance for your business. The types and amount of insurance that you need for your small business are based on several factors. Ask yourself: What type of business are you in? Where is it located? Do you have employees?

Read MoreFrom drones and 3-D printing to artificial intelligence and autonomous vehicles, disruptive advancements in technology are everywhere – and they’re rapidly changing traditional business models across industries. While these trends may help improve efficiency, safety, and service, their increasing adoption also introduces new liability risks for the businesses that choose to incorporate them.

Read MoreNo business is too small to be sued, burglarized or damaged by a fire. And no business owner wants an unexpected event to wipe out their hard work or investments. Thankfully, small business insurance can help protect your company and safeguard your income.

Read MoreThe main difference between general liability and professional liability is in the types of risks they each cover. General liability covers physical risks, such as bodily injuries and property damage. Professional liability covers more abstract risks, such as errors and omissions in the services your business provides.

Read MoreMost standard property insurance policies cover property while it is on or within a specific number of feet of the premises, such as 100 or 1,000. That office laptop is covered while the salesman carries it to the parking lot and drops it on the back seat of his car, but not once he leaves the parking lot.

Read More