Higher Pay for Skilled Construction Workers Fuels Ongoing Increases in Rebuilding Costs

Higher reconstruction costs faced by the commercial property/casualty insurance industry are being driven more by rising labor costs than by materials, according to recent data and industry sources.

While material costs continue to rise because of inflation, and potentially tariffs, labor costs are increasing more steeply because of a supply/demand imbalance, especially among skilled trades such as electricians.

The demand for skilled trades drives up costs because workers can command higher wages.

The imbalance predates the current disruptions in U.S. immigration flows and is primarily the result of fewer people entering the trades, sources said.

The competition for qualified labor has been going on for a while, said John Flocco, Denver-based executive vice president, design and construction, for USI Insurance Services.

“That’s been a long time coming, especially skilled labor, skilled trades like electricians, plumbers, heavy equipment operators, masons,” he said.

A robust construction sector, including massive data center projects fueled by the artificial intelligence boom, is creating competition for skilled labor, according to Hunter Bendall, Tysons Corner, Virginia-based national construction practice leader for Marsh McLennan Agency.

“The availability of subcontractor labor is limited,” Mr. Bendall said, and the high margins available on data center projects draw the high-performing subcontractors.

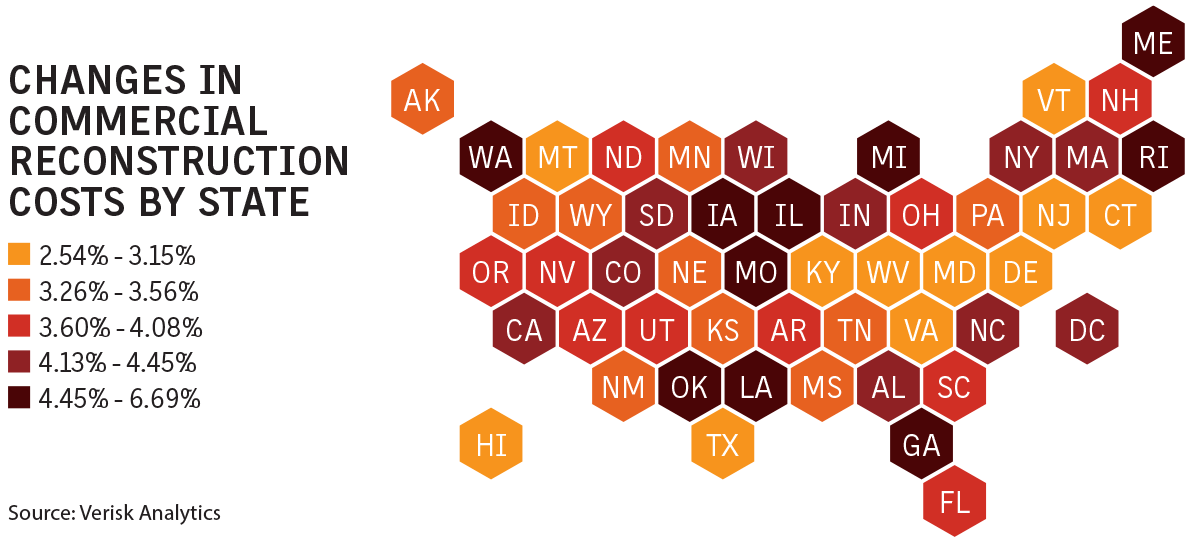

Total reconstruction costs in the United States, including for materials and retail labor, increased by 3.8% from October 2024 to October 2025, down from 4.9% during October 2023 to October 2024, according to a recent report from Verisk.

Total commercial reconstruction costs increased 4% over the 2024-2025 period, the report said.

Material costs rose by 2.19%, and combined hourly billable labor costs increased by 4.49%, forming the most significant component of the overall cost increase.

“There still is a shortage on the labor side of things,” even though the number of permits for new construction has declined during the past 12 months, said Greg Pyne, Lehi, Utah-based vice president, Verisk Property Estimating Solutions.

Overall reconstruction cost increases have dropped back to a low-single-digit range typical before the COVID-19 pandemic, according to Trish Hopkinson, associate vice president, Verisk Underwriting and Data Analytics Property Solutions.

“We’re much closer to what we were pre-pandemic, where typically reconstruction costs year over year on average nationally were in the 3% to 4% range. We’re back in that space now,” she said. Pandemic-related disruption caused supply chain delays that pushed up reconstruction costs.

“The demand for skilled labor is causing some of that challenge in the marketplace,” said Matt Wagner, Chatham, New Jersey-based regional vice president, East, for construction at Zurich North America.

“There’s a known retirement bulge for master-level trades and the training pipeline to get people up to that skilled standard for a project site hasn’t necessarily kept pace,” Mr. Wagner said.

The evolving tariff situation has yet to translate into substantial price increases.

Axa XL asked its largest independent adjusters to identify “any tariff-type costs” they may see being added to a claim, said Mark Evans, Hartford-based head of property claims for the insurer.

“I think we’ve only had one example over the last month of something having a higher cost because of a tariff,” he said.

“We’re not really seeing impacts or significant ones anyway, in building costs around things that are impacted by tariffs … those costs haven’t quite flowed through,” said Verisk’s Ms. Hopkinson.

Price increases may eventually come, but it is difficult to forecast with the changing outlook for tariffs, she said.

The tariffs have had a “negligible” effect on material costs so far, said MMA’s Mr. Bendall.

“Back in March or April, everyone was scared that material was going to start to go through the roof. The pricing increases never really came. That’s not to say that they couldn’t come in 2026,” he said.

Push to address trade labor shortfalls intensifies

A shortage of skilled tradespeople, such as electricians and masons, has spurred the construction industry to intensify its recruitment to mitigate rising labor costs and shortages at job sites.

Skilled craftspeople have been in decline for years, as fewer people choose these trades as careers, construction industry sources said.

That tide is shifting as contractors and others bolster efforts to attract new talent.

Large general contractors are aggressively recruiting talent at a much younger age, including getting high school and college-age students interested in construction, said Matt Wagner, Chatham, New Jersey-based regional vice president, East, for construction at Zurich North America.

“They’re investing a lot of time into that, because they’re trying to be proactive about that pipeline gap,” he said.

Hunter Bendall, Tysons Corner, Virginia-based national construction practice leader for Marsh McLennan Agency, also sees greater efforts being made to address the labor shortfalls.

“I think the schools are recognizing the value of the trades,” Mr. Bendall said. “The trades haven’t done a very good job of telling their story the past 20 to 25 years, but I do think the tide is turning. I’m passionate about the construction industry, because I think it provides so many different opportunities for absolutely anyone to step in and succeed.”

Compliments of Businessinsurance.com

Dan Zeiler

Dan@zeiler.com

877-597-5900 X134